The 10 Best Buy Now Pay Later Catalogs Sites With Instant Approval

Are you Searching for the best Instant Approval Buy Now Pay Later Catalogs Sites?

You can spread out the cost of your purchases rather than paying for them all at once by using the buy now, pay later payment options that are available on numerous websites and catalogues (both online and offline).

There is little doubt that purchase now pay later retailers online will grow in popularity in the future given the current status of the economy. Furthermore, purchasing from online shops and outlets is increasingly more popular than purchasing from conventional general merchandise department stores.

Mobile buying is on the rise and is anticipated to keep growing, taking online purchasing one step further.

Due to the nation’s widespread layoffs and business closures, many household budgets may experience severe cutbacks in family income in addition to credit issues.

That will have an impact on many families’ financial situations.

Rest assured that many online retailers provide buy now pay later apps without requiring a credit check. Some retailers even provide customers with buy-now, pay-later catalogues that don’t require a credit check. In years to come, payment plans for current purchases will rise.

Even Walmart has a buy now, pay later option for customers who might be having trouble during this challenging time.

The Home Shopping Network (HSN), Progressive Leasing, QVC, Stoneberry, Fingerhut, and other well-known websites that allow customers to pay later with no credit check, rapid approval, or money down are just a few examples. Many of these shops provide online shopping options with guaranteed credit. If you use these store alternatives, you can buy now and pay later even if you have bad credit.

There are a tonne of websites that offer options for buy now, pay later. Other online purchase now pay later retailers also provide possibilities, such as stores that accept easy payment as well as postponed billing. If you’re wondering if cancelling your credit card would halt regular payments but you still need to make purchases, the solutions listed below are good alternatives. If you do need to cancel a card or are attempting to stay away from credit bureaus, buy now pay later is a fantastic choice.

In-house or through a third-party financing provider, store credit cards, rent-to-own and lease-to-own programmes, and instalment plans are all available.

Customers with less-than-perfect credit can be accepted by many buy-now, pay-later payment plans, and some even don’t require a credit check.

Make sure you can afford to pay for the complete purchase before registering for buy now, pay later programmes by being mindful of late fees and interest rates.

Online purchasing has becoming the new standard as people prepare for the unforeseeable future by barricading themselves in their homes. To lure customers, several online retailer credit cards provide guaranteed acceptance.

Even CNN has reported that consumers’ alternatives for making easy monthly payments while still purchasing items later online are rising.

Many online shops provide the option to pay now and then. Buy now pay later websites are easy to find. There are possibilities for no credit check purchase now, pay later cell phone financing as well.

You’ll note that a few of these retailers below provide clothes catalogues with buy now, pay later options. Perhaps one of your moving tips to save money when relocating out of state was to sell a lot of your clothing.

Use clothes catalogues with “buy now, pay later” options to replace some of the clothing you had to sell when you moved.

If you are unable to leave the house, using buy now pay later clothes catalogues is another excellent approach for customers to make purchases online.

This is excellent if you are currently struggling since you are unable to work or are entirely unemployed. An extensive list of online retailers that accept flexible payment methods is provided below.

Only invest in things you can afford to pay off to avoid spending more than necessary for them. To prevent missed payments, late penalties, interest accumulation, and other repayment problems, it is a good idea to have a repayment strategy in place.

Below, we provide a list of the 10 Best Buy Now Pay Later Catalogs Sites With Instant Approval in each category, along with details on their costs and conditions.

What exactly is a “Buy Now, Pay Later” Catalog?

Customers can use this technique to buy desired items from an online selection of buy now pay later goods and then pay for them over time in monthly instalments.

Even a high credit score is not necessary to qualify. Retailers which have a large client demand for expensive goods like furniture for the home, appliances, electronics, etc. frequently provide this form of financing.

How Does the Buy Now, Pay Later Work?

The retailer will give you a window of time, typically without interest, in which you can pay the item off in full. The majority of stores will have a transition time of six months to a year. You will be required to make some monthly payments during that time, the amount of which will vary.

The retailer will do one of three things once the interest-free period ends: charge you a high interest rate, add a monthly fee on top of your current instalments, or charge you a percentage of the purchase price on top of the total amount you must pay.

Of course, paying up the item’s cost during the interest-free term is the ideal course of action. The interest you will have to pay once the period is over can range between 20 percent and 40 percent, so it would actually be the safest course of action.

You can end up spending almost half the item’s price just on interest. On the other hand, the majority of buy now, pay later plans are pretty reasonable and allow you lots of chances to pay in full before the extra fees start.

Here are some buy-now, pay-later directories that don’t check your credit and have both offline and internet retailers.

The 10 Best Buy Now Pay Later Catalogs Sites With Instant Approval

Big Lots is an online store with a focus on food, electronics, home items, clothing, and much more.

This catalogue is for you if you’re seeking for one with a large selection of products to choose from.

This catalogue is for you if you’re seeking for one with a large selection of products to choose from. Progressive leasing is a type of leasing that includes leasing. Additionally, they don’t do credit checks.

You must fulfil a few conditions before making purchases from this catalogue.

Requirements Before Beginning

You must be at least 18 years old to be eligible to apply. But it’s not just that;

Additionally, you had to have a stable job for at least six months before making the purchase.

Both a credit or debit card and an open checking account with your bank are requirements.

You should make at least $1,000 per month and have $500 or more in your checking account.

Although they may seem like strict standards, anyone who is employed—even if they are just paid minimum wage—can easily meet them.

The initial lease payment, which you’ll make as a purchase, and then once a month after that will be the only down payments you’ll need to make.

2. Conn’s Home Plus

As implied by the name, Conn’s Home Plus sells electronics, computers, and other home furniture and equipment. It is a terrific place to shop if you want to upgrade your home with new furnishings or appliances but can’t afford to pay the whole price up front.

Once more, progressive leasing, a buy-now, pay-later payment strategy, is the foundation of this programme. You must also fulfil a few more conditions in order to be qualified for the programme.

Prior to making a purchase of the goods, you must be at least 18 years old and have been employed for at least six months.

Additionally, a credit or debit card is required.

Additionally, you ought to have a bank checking account with a minimum $500 deposit.

The first minimum payment, which you will make as soon as you complete the purchase and then once a month after that, serves as the down payment for the purchase.

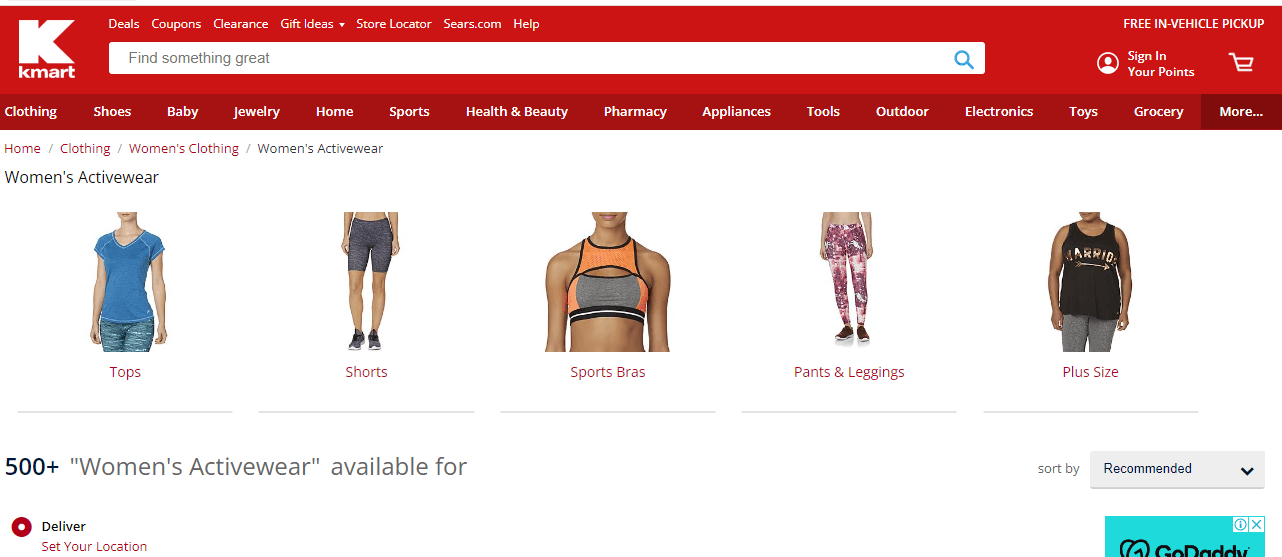

3. Kmart

In addition to typical home goods, electronics, food, furniture, and apparel, Kmart also sells a variety of other commodities. If you’re searching for a general store that can meet all of your needs, this is a great choice. There is no credit check necessary for the scheme, which is run by WhyNotLeaseIt.

Its requirements differ slightly from those of Progressive Leasing.

To qualify, you must still be at least 18 years old and make $1,000 or more each month at your employment.

You must also have a Social Security Number and a government-issued photo ID, such as a current driver’s licence.

These conditions are, undoubtedly, a little more lax than those of Progressive Leasing.

The first lease payment, which must be fully paid at the time of purchase under this programme, serves as the down payment. You will then pay once each month after that.

4 Leaseville No Credit

It’s important to note that Leaseville No Credit is a distinct legal organisation and not a division of Leaseville before we discuss Leaseville. The Leaseville store runs credit checks on prospective clients before granting them finance. Contrarily, Leaseville No Credit doesn’t run your credit.

Furniture, appliances, electronics, lawn and garden equipment, music and fitness equipment, lawn and garden supplies, and even jewellery are all sold through Leaseville No Credit. This catalogue is for you if you’re seeking for a place to acquire outdoor gear without having to pay for it all at once.

The Leaseville No Credit Leasing company, which runs the scheme, doesn’t run credit checks. These are the specifications.

You must have held a stable job or received government benefits for the past six months in order to be eligible for the programme.

Your monthly income should be at least $1,000.

Additionally, you must have an open checking account that is currently operational, has been open for at least three months, and has not experienced excessive overdrafts or non-sufficient fund problems in the previous 30 days.

Additionally, there must be at least $500 in deposits and 5 transactions each month.

Prepaid debit or credit cards are also not accepted as payment methods.

Although these requirements are a little onerous, they can nonetheless be fulfilled.

The initial lease payment, which is due at the time of purchase, is equivalent to the down payment.

5. Overstock

Not all states are covered by this programme. You won’t be able to access it if you reside in Wyoming, Wisconsin, Vermont, Utah, Pennsylvania, New Jersey, North Carolina, Kentucky, Connecticut, Arkansas, Alabama, Hawaii, or Washington.

General retail products like electronics, furniture, home goods, and clothing are sold by Overstock. The programme, which doesn’t require a credit check, is run by Progressive Leasing.

At least 18 years of age is required.

Having had a consistent job for at least six months.

Holding a valid credit card, debit card, or bank account.

A direct deposit of at least $1,000 and no less than $500 of your monthly salary into your checking account.

The $49 deposit must be made at the time of purchase. Overstock is ready to accept your online application when you are.

6. Sears

A well-known shop, Sears is renowned for providing a wide selection of goods at reasonable costs. It offers a variety of commodities for sale, such as electronics, food, household items, furniture, apparel, and much more. WhyNotLeaseIt powers the Sears leasing programme, which has no credit check requirements.

A few conditions must be satisfied in order to qualify for the programme. Being at least 18 years old and making $1,000 a month are two of these prerequisites. You also need a current Social Security number and a form of government-issued photo identification, such as a driver’s licence.

The first payment, which needs to be made right away after buying the item, is the down payment for the programme. Apply online by completing the Sears LeaseIt application. The fact that this programme has a few straightforward needs makes it a great idea.

7. The Zebit Market

Zebit Market is an excellent choice for individuals looking for a store where they can quickly buy gifts for their loved ones because it provides a wide variety of products. Gifts, books, accessories for health and beauty, jewellery, technology, and home decor are all sold there. The programme, which is run by ZebitLine Credit, does not perform credit checks.

You shouldn’t have any issue fulfilling the program’s minimal requirements when seeking to order a good from the service. You must be at least 18 years old, as well as employed, receiving benefits, or retired in order to qualify. Additionally, there is no requirement for a down payment. The program’s eligibility standards are so straightforward that practically everyone can meet them.

There are three programmes for “buy now, pay later” that do credit checks. They only perform “soft” credit checks, though, which have no impact on your credit score. An appropriate approach for raising your credit score is a gentle credit check. You won’t lose any points, and you’ll also get a new credit line. If you make on time payments, this could help your credit score over time.

8. The bluefly

Bluefly offers a variety of goods for sale, including electronics, furniture, jewellery, cosmetics, household goods, as well as clothing, accessories, and footwear for both men and women. You must be at least 18 years old and have a current social security number in order to qualify.

Your credit score will decide the down payment. If you have low credit and were still approved, you will need to put down a small amount of money. If your credit is good, you will make your first payment 30 days following the date of purchase. You can apply online at this time with the help of the Bluefly office website.

9. The FlexShopper

This store offers a wide range of products, including furniture, electronics, cell phones, computers, video games, appliances, and home and garden items. The credit scheme is operated by FlexShopper Credit.

You must have an active checking account with a bank that has been open for at least three months—or 90 days—and make at least $1,000 in monthly salary to qualify. The first payment payable on the day of purchase is the down payment. For fast shopping, visit the FlexShopper website.

10. Fashion to Figure

A plus-size fashion apparel and accessory retailer is called Fashion to Figure. The foundation of the programme is Affirm. You need a social security number, a working phone number, and must be at least 18 years old. Your credit score will decide the down payment. If you have ordinary to good credit, you will only need to pay the first instalment after 30 days from the date of purchase. If you have poor credit, you will be forced to pay a small down payment.

The Following Are Frequently Asked Questions

What happens if you don’t pay back?

Each and every one of the buy now pay later services has specific needs, rules, and regulations that govern it.

The repercussions of defaulting on a “buy now, pay later” loan can vary from business to business.

Generally, when you don’t pay back for a good or service.

Your account will be frozen by the lender to stop additional transactions, and your debt can be transferred to a debt collector as a result.

Once reported to a credit reporting firm and turned over to a debt collector, the debt might potentially lower your credit scores.

If you have bad credit, is it still feasible to use pay later options?

There are currently a number of buy now, pay later options available online, each with its own set of guidelines.

While some people might not agree with having terrible credit, others would.

Because of this, if your credit score is exceedingly low, you need take the time to conduct thorough research so that you can identify and select the one that takes a negative credit score.

Is a bank account required to rent to own a property?

As long as you have a functioning bank account and can make the payments, bad credit is not a problem.

Instead of waiting until the future to pay for a significant purchase, you can pay for it now by making monthly instalments. On some websites, you can receive a leasing credit limit of up to $5,000, and the application process is quite quick—it only takes a few minutes. When the application is complete, make an investment in top-notch goods.

Summary

If you’re looking for a terrific purchase now, pay later programme without credit, all of these are great catalogues.

What We Suggest

Choose a store that sells goods in a range of categories, such as Big Lots or FlexShopper. if you’re trying to find a generic buy now, pay later choice that can be used for many different products.

Options for particular goods While typical shops give you additional purchasing alternatives, especially if you have a high credit limit or choose to utilise the purchase now, pay later service more than once, our list covers products like apparel and pet supplies.

If Zebit carries the product(s) you’re looking for, it’s the greatest overall choice. There are no interest or late fees associated with this market’s services.

Due to their flexible payment choices, Overstock and Leaseville No Credit are also worth considering (with two buy now, pay later payment methods available at each store).