Have you heard about the Skrill Virtual Master Card but are unsure how Get FREE Skrill Virtual Master Card in 2022 ?

You have found the website page with a thorough response to your search query, so congratulations.

The virtual card provider Skrill is a strong competitor of PayPal and other virtual card issuers and offers an online shopping option.

One of the best payment gateways available today is Skrill, a superb platform in its own right.

Freelancers, Woocommerce websites, business entities, etc., can accept payments from anywhere in the world with the Skrill Virtual Master Card.

Similar to PayPal, Skrill may be connected onto any website to accept users’ fixed payments, and it even flawlessly supports PayPal verification.

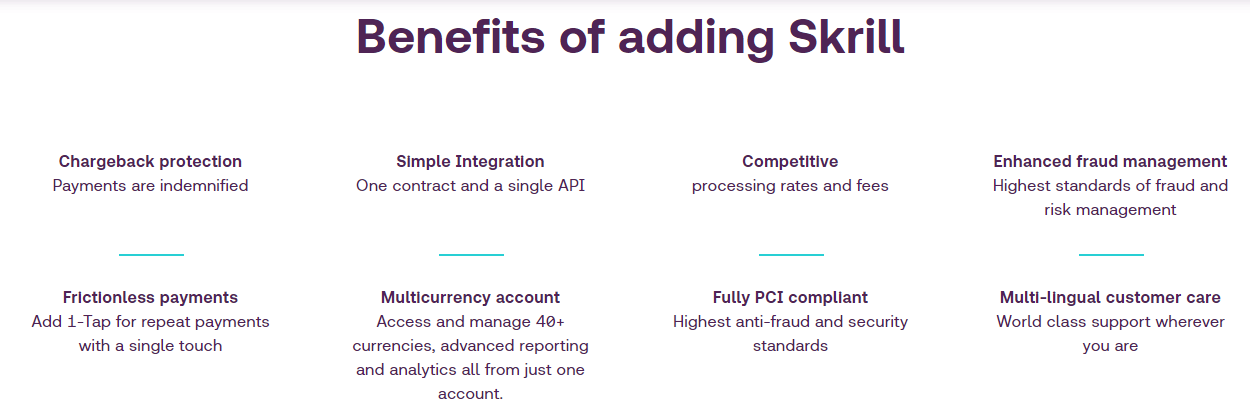

When it comes to security, Skrill provides top-notch protection, setting the company’s platform apart from others that can be utilized to take payments.

Skrill also makes it easy for anyone to open a free account, attach a credit or debit card, and begin sending and receiving money internationally.

However, you will need to confirm some information before you get full access to some platform features.

US citizens, citizens of the European Union, and citizens of the SEPA Zone can get a free virtual card online when using Skrill;

For US residents and non-US residents, there will likely be a virtual prepaid MasterCard and virtual prepaid Visa card, respectively.

This article will explain how to easily obtain a Free Skrill Virtual Master Card.

What is Skrill & How Does it Work?

Get FREE Skrill Virtual Master Card in 2022

Online-Wallet-for-Money-Transfers-Online-Payments- -Skrill

You can utilize the money in your Skrill Account to make online purchases everywhere Mastercard is accepted thanks to the Skrill Virtual Prepaid Mastercard. It cannot be used offline or at ATMs because it is a virtual card. It can only be used to make payments online.

One of the key advantages is that, as opposed to the standard plastic Skrill MasterCard, you can choose how long you want it to be active, adding an extra layer of security and preventing any fraud.

A digital wallet called Skrill, which was introduced in the year 2001, enables users to pay for services online and transfer funds between platforms.

An excellent platform for sending and receiving money internationally is Skrill.

Skrill currently operates in over 120 nations and offers 40 different currencies from well-known nations including the USA, Canada, and others in their digital wallet.

Since its launching, Skrill has made it simple for millions of grateful users to send, receive, and spend money online.

You may easily use Skrill to manage your transactions successfully no matter where you are.

Additionally, you can use Skrill to send money, make payments online, place bets, trade foreign exchange, and even purchase cryptocurrency for a pittance using real-time exchange rates.

Skrill accounts can be created quickly and easily.

To verify and activate your freshly formed Skrill account, simply browse to the website, sign up using your email address and your chosen password, and then follow the on-screen instructions.

Does Skrill issue both virtual cards and physical prepaid master cards? Difference

Physical Prepaid Master Mards and Virtual Cards? Difference

When it comes to financial transactions, both for online casino games and other online payment gateways, the Skrill prepaid Mastercard is an excellent instrument.

The Skrill prepaid Mastercard’s most intriguing characteristic is that it works well on all platforms that recognise Mastercard.

Allows you to always have fast access to your account balance while using the Skrill Prepaid Mastercard.

Additionally, players can top up and withdraw money from their online casino accounts using their Skrill Prepaid Mastercard.

Additionally, you can use your Skrill Prepaid Visa to make contactless payments at retail locations all around the world and to make ATM withdrawals.

Unfortunately, depending on your Skrill VIP level, there are various daily restrictions and costs for ATM withdrawals.

Prepaid cards from Skrill Virtual, on the other hand, are created and sent electronically.

If you have a Skrill Virtual prepaid card, you can use it to conduct transactions while you’re on the go or to make one-time payments.

Additionally, you must add money to your Skrill Virtual prepaid card before you may use it.

Your Skrill Virtual prepaid card will function like a regular plastic card while making purchases once you have funded it.

You only need to input the 16-digit card number, the CVV security code, and the expiration date to make payments.

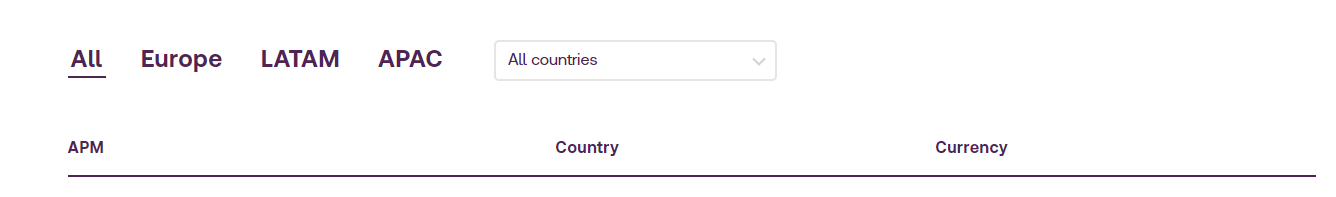

Which Country is Eligible or Supported to Get a Skrill Virtual Card/ MasterCard?

Get FREE Skrill Virtual Master Card in 2022

Skrill is a great platform with a large number of nations that support its services.

You are permitted to open a Skrill account, conduct business with merchants, and add to or withdraw money from your Skrill account in the nations mentioned below.

Additionally, Skrill recently stopped offering MasterCards to citizens of non-SEPA nations.

These countries include:

Albania, Algeria, Andorra, Antigua and Barbuda, Argentina, Armenia, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Bangladesh, Belarus, Belgium, Belize, Bhutan, Bolivia, Bosnia & Herzegovina, Brunei, Bosnia And Herzegovina, Botswana, Brazil, Brunei, Bulgaria, Cabo Verde, Cambodia, Cameroon, Canada, Chile, China, Colombia, Costa Rica, Côte d Ivoire,

Croatia, Cyprus, Czech Republic, Denmark, Dominica, Dominican Republic, DR Congo, Ecuador, Egypt, El Salvador, Estonia, Ethiopia, Fiji, Finland, France, Georgia, Germany, Ghana, Greece, Guatemala, Haiti, Holy See, Honduras, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Jamaica, Jordan, Kenya, Kiribati, Kuwait, Latvia, Lebanon, Lesotho, Liechtenstein, Lithuania, Luxembourg, Malaysia, Maldives, Malta, Marshall Islands, Mauritius, Mexico, Micronesia,

Moldova, Monaco, Montenegro, Morocco, Mozambique, Netherlands, New Zealand, Nicaragua, Nigeria, Norway, Oman, Pakistan, Panama, Paraguay, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russia, Rwanda, Saint Lucia, San Marino, Sao Tome & Principe, Saudi Arabia, Senegal, Serbia, Seychelles, Singapore,

Slovakia, Slovenia, Solomon Islands, Somalia, South Africa, South Korea, South Sudan, Spain, Sri Lanka, St. Vincent & Grenadines, State of Palestine, Swaziland, Sweden, Switzerland, Tanzania, TFYR Macedonia, Thailand, Tonga, Trinidad and Tobago, Tunisia, Turkey, Tuvalu, U.K., U.S., Uganda, Ukraine, United Arab Emirates, Uruguay, Vanuatu, Venezuela, Viet Nam, Zambia, Zimbabwe

Why Can’t I get Skrill Physical MasterCard or an Instant virtual Card?

If Skrill’s quick virtual card or actual MasterCard were unavailable to you,

It’s possible that neither the actual MasterCard issued by Skrill nor the immediate virtual card are available in your country.

Below are the countries where you can use all Skrill services including the PrePaid MasterCard.

Belgium, Cyprus, Netherlands, France, Denmark, Sweden, Germany, Latvia, Portugal, Estonia, Poland, Iceland, Greece, Lithuania, Slovakia, Bulgaria, Romania, Liechtenstein, Ireland, Luxembourg, Slovenia, Great Britain, Croatia, Monaco, Spain, Malta, Finland, Hungary, Czech Republic, Norway

How to Create and Verify Skrill Accounts

Get FREE Skrill Virtual Master Card in 2022

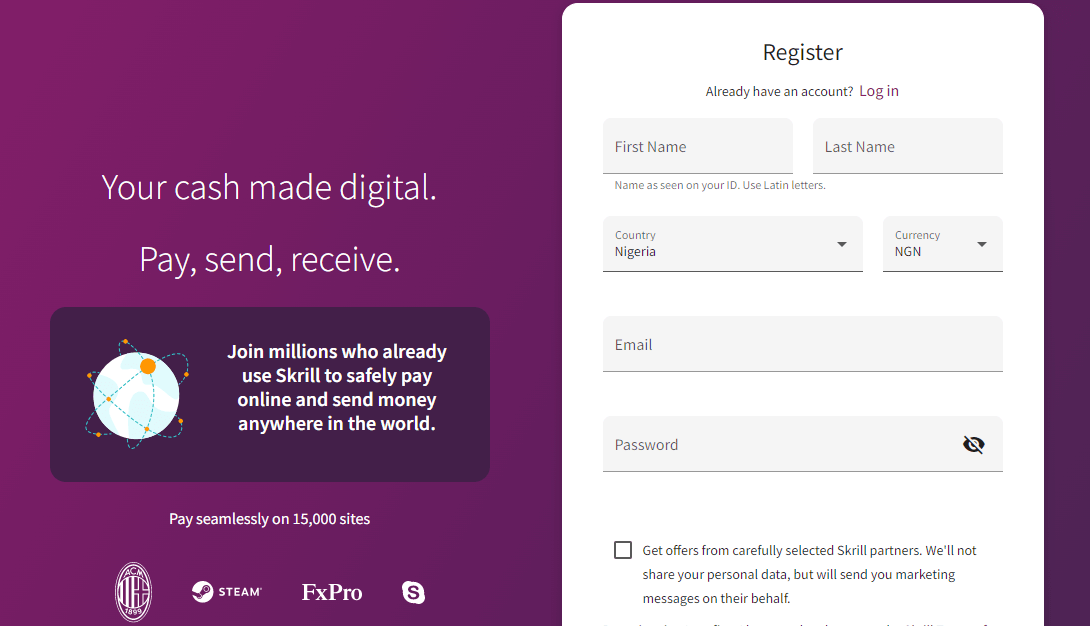

The first step to getting a free virtual MasterCard through Skrill is opening an account, thus doing so is very important. Here is a detailed tutorial on signing up for Skrill.

Below are the steps to follow while planning to create a Skrill account:

- On the Skrill website, using your computer, click the register button. The register button is situated in the screen’s upper right corner. You can also go ahead and create your Skrill account by clicking the “Get started” button.

- You must complete a registration form with your information on the registration page.

- Your account will be created immediately once you have entered all the information needed. You’ve now successfully registered for a Skrill account.

- You must upload your ID documents, which will be evaluated in a matter of minutes, in order to authenticate your Skrill account. Your freshly established Skrill account will be immediately validated after being accepted.

How to Create Skrill Virtual Card

To create and get a Skrill Virtual Prepaid Card, follow the steps below:

- You must first register for a Skrill account and confirm it. After logging in, a menu will appear on your account dashboard.

- Next, select “Get a Skrill card” from the menu.

- Additionally, if you already have an account, simply click “Add Card” in the “Skrill Virtual Cards” category.

- Here, you must upload your ID documents in order to authenticate your account. Please upload only legitimate documents.

- You will next be given a form to complete and choose the local currency of your choice. Here, make sure to choose the currency that is accepted in your nation. By doing this, you can avoid paying conversion costs when using your Skrill account on regional websites or in retail establishments.

- Your Skrill Virtual card will instantly be generated once you have finished filling out the form and selecting your preferred local currency. Note: The 16-digit card number, expiration date, and CVV are all included with this virtual card. You can use the card further to make payments and purchases using the information on it.

- You have now received your free virtual Skrill card, which you may use to make online purchases or sign up for free trials.

How to order a Skrill Virtual MasterCard

Virtual MasterCard for Skrill

The procedure of ordering your card is quick and simple. You must first confirm that there are funds in your Skrill account. The card can then be ordered by:

Simply select “Skrill Card” from the list of options on the left side of your Skrill Account.

Click “Add a Card” in the Skrill Virtual Cards section.

Fill out the form by choosing the Card Currency (available in PLN, GBP, USD, and EUR); be sure to select the currency you use for the majority of your transactions to avoid paying exchange fees.

Your Skrill Virtual Mastercard’s 16-digit number, CVV security code, and expiration date will be provided to you once it has been generated. Now, you can use the card number that Skrill Virtual produced at any business that takes MasterCard.

Please be aware that only clients from the EU may use the card (SEPA Region). The card cannot presently be ordered by or added to the accounts of customers from other nations.

Why Choose a Skrill Virtual Card?

Get FREE Skrill Virtual Master Card in 2022

How to Get FREE Skrill Virtual Master Card in 2022

Below are the core benefits of the Skrill virtual card:

#1. You can pay securely and discreetly

A very secure method of making an online payment is by using a Skrill virtual card.

Your debit or credit card information will be kept confidential with a Skrill virtual card.

This is due to the fact that your bank account is not at all connected to the payments you made using your Skrill virtual card.

#2. It is budget effectively

Users of the Skrill virtual card are limited to using the funds they have added on the card for purchase.

Users will then be able to keep track of their online spending; thanks to this.

Additionally, if your card company provides a mobile app for users, you can download it to receive notifications for every single transaction that occurs on your account.

#3. You can spend your funds anywhere you want

Your Skrill virtual card can be linked to a Mastercard or Visa since virtual cards are made specifically for online transactions.

This enables you to do transactions on any platform anywhere in the world.

Moreover, you can load money onto your Skrill virtual card and use it to make online payments in some nations where you don’t have access to banking services.

#4. Users can use their preferred currency

Skrill supports a wide range of currencies, so when making payments, you can select a currency that is the same as your home currency.

#5. Faster payment

You can make immediate payments with the Skrill virtual card instead of having to wait for your physical card and PIN to arrive at the post office. Regardless of where you are, it is extremely quick and practical.

Skrill Virtual Card Fees & Limit

Get FREE Skrill Virtual Master Card in 2022

The platform Skrill is pretty exceptional and is provided without charge to users.

Additionally, the user’s account does not have any additional or secret fees.

Additionally, customers must incur some conversion fees when transacting with third-party services that only take payments in a particular currency.

Depending on the currency you are converting and the amount you want to convert, currency conversion fees on the Skrill platform might be as high as 3.99 percent.

Meanwhile, consumers who frequently conduct conversions with Skrill are required to pay a 10 EUR annual service fee.

Skrill also offers free services for getting balance enquiries, online statements, PIN requests, receiving cash, and making online purchases.

Additionally, a user’s first Skrill digital card is free, but unfortunately, additional Skrill digital cards cost €2.50.

Examples of Websites that Accept Skrill Virtual Card

Below are some websites where you can use your Skrill virtual card to make payments:

- eBay

- AliExpress

- Amazon

- Skype

- Steam

- PokerEnergy.net

- Grandeshopping.it

- DHgate.com

- FxPro

- Exness

- Pokerstars

- GGPoker

- PartyPoker

Can Skrill Free Virtual Card use for PayPal Verification?

The quick response to this query is YES!

Your Skrill virtual card can be used to verify your PayPal account by linking it to your PayPal account.

To achieve this, follow the steps below:

- Log in to your PayPal account

- Navigate to “Wallet”

- Click on “Link card” to link your Skrill virtual card to your PayPal account

- When you are done, click on confirm credit card option to confirm the virtual card you just added.

- Wait while PayPal sends you a verification code.

- Next re-login to your PayPal account and enter the verification code.

Is Skrill Better than Payoneer?

Being a top platform, Skrill provides its services across a wide range of nations and currencies.

Payoneer, on the other hand, has very limited capability internationally.

For instance, Payoneer only supports a limited number of currencies for receiving payments.

The fact that Skrill has no transaction fees when sending money overseas is another wonderful advantage it has over Payoneer.

Furthermore, Payoneer and Skrill are both very reliable, highly secure, and user-friendly platforms for money transfer services.

Another fantastic advantage is that Skrill accepts Bitcoin as a payment option, but Payoneer does not.

You should read this; Payoneer Alternative: Transferwise (Now Wise) Borderless International Money Transfers Solution.

Conclusion

Get FREE Skrill Virtual Master Card in 2022

Comparing Skrill Virtual Card to its competitors and alternatives like PayPal, Payoneer, etc. reveals that it is a really impressive payment gateway created specifically for online shopping and that it has a tonne of features.

Freelancers, Woocommerce websites, business entities, etc. can accept payments from anywhere in the world with the Skrill Virtual Master Card.

Additionally, Skrill is a transparent platform that doesn’t charge its users for transactions.

When compared to other systems, Skrill has the enormous advantage that while utilizing Skrill,

You can pay more quickly, in a secure manner, and it will aid you in creating an efficient budget, among other benefits.